Scammers Pretending To Be HMRC

27th June 2022Scammers pretending to be HMRC are out in force once again. We have seen a rise in scam emails, texts and telephone calls. The fraudsters are even using What’sApp!

The main aim of these scams is to;

steal money from your bank account,

persuade you to send money,

give them enough personal information so that they can sell it to other crinimals that will then perform identity theft.

Scammers are now using number spoofing to make your phone display ‘HMRC’ as the sender, instead of a phone number. Phishing emails often look official and can look like they are being sent from official government email addresses. Malware is often sent to your computer or phone if you open the links that have been attached to the email or text. Malware (short for malicious software) comes in different forms; Trojans, Rootkits, Botnets, Spyware and worms to name but a few.

Telephone

HMRC is aware of an automated phone call scam which will tell you HMRC is filing a lawsuit against you, and to press 1 to speak to a caseworker to make a payment. We can confirm this is a scam and you should end the call immediately. Sometimes the scammers will claim that your National Insurance number has been used fraudulently. Other phone calls are offering bugus Covid grants or claiming your direct debit has failed.

Emails

Tax phishing emails can be sent at any time, but they usually become more prevalent around key tax deadline dates. HMRC WILL NOT email you to advise you that your tax code has been changed. They will never send you notifications about tax rebates or refunds. Within these emails there is quite often a link to click on in order to get your refund. DO NOT click on this link. Similarly, NEVER open any attachments or disclose any personal or payment information.

Fraudsters may spoof a genuine email address or change the ‘display name’ to make it appear genuine. Scammers are often signing off the email with a name or signature of a genuine HMRC employee to make the scam email even harder to spot. If you are unsure, forward it to HMRC and then delete it.

Forward it to this email address – phishing@hmrc.gov.uk

Texts

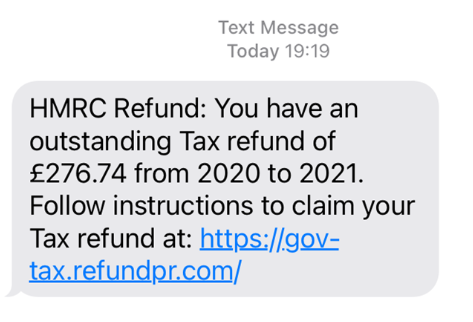

HMRC will never ask you for your personal information if they send you a text message. Nor will they ever ask you for financial information. Do not reply if you receive a text message claiming to be from HMRC offering you a tax refund – like in the picture below.

The image above shows an example of a scam HMRC text message. The scammers pretending to be HMRC are trying to get you to click on a hyperlink and for you then to enter personal details. Do not click on or open any links. You can forward scam texts to 60599 (network charges apply)

What’s App

HMRC will never use ‘WhatsApp’ to contact customers about a tax refund. If you receive any communication through ‘WhatsApp’ saying it’s from HMRC, it is a scam.

Social Media

HMRC will never use social media channels/platforms to offer a tax rebate or request personal or financial information. A recent scam has been identified on Twitter, offering someone a tax refund. These messages are not from genuine HMRC social media accounts and are a scam. If you cannot verify the identity of the social media account, send the details by email to: phishing@hmrc.gov.uk and ignore it.

Rebate and refund are tempting words, but HMRC will never ask for your bank account details via text or email. Being contacted out of the blue is quite often a sign that it is a scam. Try to verify their identity by asking them a question about the company that only you would know. Your tax reference number for example. Ultimately, if you are not happy, you feel uncomfortable, then hang up or delete/report the message.