Domestic Reverse Charge For VAT

22nd March 2021The Domestic Reverse Charge (DRC) is a new way of accounting for VAT for builders and others caught under the construction industry wrapper.

It will apply to all VAT registered construction businesses in the UK. The legislation moves the VAT liability from the supplier (subcontractor) of a service in the construction industry to the customer (contractor).

Why Has This Changed?

It has been identified that there is a VAT gap between VAT being declared, and VAT being claimed within the construction industry.

In effect, the net effect to the treasury should be £nil, as the outputs and inputs cancel themselves out. However, there is a shortfall, due to fraud that has been identified.

The Reverse Charge therefore reduces the movement of VAT being paid, and therefore reduces the exposure to fraud. However, it does cause an additional administrative burden to businesses. It will also have quite a large impact on businesses, at a time where, more than ever, “cash is king”.

What Has Changed?

As of the 1st March, when you are raising an invoice you need to check the VAT, and calculate what is chargeable under DRC VAT and what is chargeable under standard rate VAT.

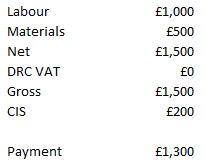

The 20% domestic reverse charge VAT is only on labour. So mixed invoices (labour and materials) will need to be carefully written and calculated. This way it will be clear for you and the customer.

When to Use the Reverse Charges

You must use the reverse charge for the following services:

- constructing, altering, repairing, extending, demolishing or dismantling buildings or structures (whether permanent or not), including offshore installation services

- constructing, altering, repairing, extending, demolishing of any works forming, or planned to form, part of the land, including (in particular) walls, roadworks, power lines, electronic communications equipment, aircraft runways, railways, inland waterways, docks and harbours, pipelines, reservoirs, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence

- installing heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems in any building or structure

- internal cleaning of buildings and structures, carried out in the course of their construction, alteration, repair, extension or restoration

- painting or decorating the inside or the external surfaces of any building or structure

- services which form an integral part of, or are part of the preparation or completion of the services described above – including site clearance, earth-moving, excavation, tunnelling and boring, laying of foundations, erection of scaffolding, site restoration, landscaping and the provision of roadways and other access works

When You Must Not Use the Reverse Charge

Do not use the charge for the following services, when supplied on their own:

- drilling for, or extracting, oil or natural gas

- extracting minerals (using underground or surface working) and tunnelling, boring, or construction of underground works, for this purpose

- manufacturing building or engineering components or equipment, materials, plant or machinery, or delivering any of these to site

- manufacturing components for heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems, or delivering any of these to site

- the professional work of architects or surveyors, or of building, engineering, interior or exterior decoration and landscape consultants

- making, installing and repairing art works such as sculptures, murals and other items that are purely artistic signwriting and erecting, installing and repairing signboards and advertisements

- installing seating, blinds and shutters

- installing security systems, including burglar alarms, closed circuit television and public address systems

What You Need to Do

Software adjustments

> If you use Xero, they have already made the necessary changes within the software – but you have to activate the codes (a relatively simple process). When you are adding items make sure you are clicking on the correct type of VAT – 20% reverse charge VAT and then 20% standard rate VAT.

> If you use Quickbooks online, there are no pre-created VAT codes for the DRC. To add the required codes, you will need to click on “manage rates” under the VAT drop down, and activate the CIS VAT rates.

> If you use QuickBooks Desktop, there are no pre-created VAT codes for the DRC in QuickBooks. There is a good ‘How To’ guide on their website that shows you how to create tax groups/codes.

> If you use other software, please contact us for further advice.

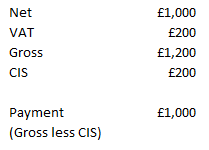

How Invoices Used To Look

What Invoices Will Look Like Now

Other considerations

> You will need to think about cash flow and consider what you need to do so that you are not short of cash at the end of the month. If you do a job for £100, you would normally charge an additional £20 of VAT. But now that you won’t be charging the VAT, you haven’t got that £20 ‘slush fund’ to play around with, before you need to pay it over to HMRC up to 4 months later.

> If you are a subcontractor you need confirmation in writing if the contractor you are working for is an ‘end user’. Invoices to end users have a standard rate of VAT charged on them.

> If you are a contractor, you don’t pay VAT to the subcontractor anymore, but you will pay it and then claim it back from HMRC on the same VAT return.

> Make sure you are happy with the term ‘end user’.

In More Depth

According to Xero’s help pages, “If you are a VAT-registered subcontractor (supplier) who provides building and construction services to a VAT-registered contractor (customer) who is CIS-registered then you no longer need to account for the VAT. Instead, your invoice should inform your customer that the VAT reverse charge is applied and they are responsible for the VAT using the reverse charge procedure. If you are a VAT-registered contractor (customer) you will instead account for both input and output tax on invoices you receive from your VAT-registered subcontractors.”

The domestic reverse charge VAT legislation is a change in the way CIS registered construction businesses handle and pay VAT. The legislation moves the VAT liability from the supplier (subcontractor) of a service, to the customer (contractor). The reverse charge is a system for accounting for VAT where the customer charges themselves VAT, rather than the supplier.

The charge applies to standard and reduced rate VAT services;

* For individuals or businesses who are registered for VAT in the UK

* For those reported within the Construction Industry Scheme (CIS)

There are clearly defined times when the reverse charge must be used, and when it must not be used.

HMRC have also stated that they appreciate that this is quite a change for the Construction Industry. We understand that penalties will not be levied in the first 6 months of this being introduced, but it is still important that businesses try to operate the scheme correctly, in order to minimise their exposure to errors.

Action Points

- You need to clarify if your customer is an end user

- You need to make the relevant adjustments in your software

- You will need to ensure your analysis between labour and materials is clearly defined, and values provided accordingly.

- You will need to consider the cash effect this will have on your business.

If you would like to discuss how the domestic reverse charge will affect you or your business, please do not hesitate to contact us.