How To Get Paid Quicker

23rd August 2021How to get paid quicker.

Invoicing does not have to be a task that you dread doing. If you use Xero to create and send invoices, your invoicing process will run smoothly AND you will get paid quicker. Want to know how?

Within this blog we will look closely at:

- Making A Great Invoice

- When and How to Send an Invoice

- Accepting Payments

- Better Online Protection

- Dealing With Overdue Payments

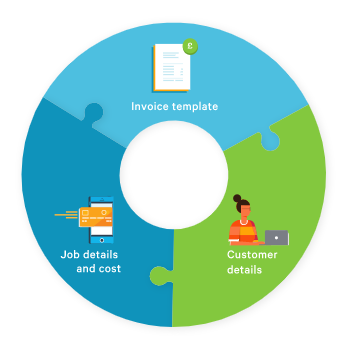

Making a Great Invoice.

Creating an invoice in Xero is very straightforward and quick to do.

When you’re in the sales invoice screen you have the choice of using new or classic invoicing.

Classic invoicing requires you to manually enter all the information, while new invoicing prefills many of the details for you.

To check which one you’re on, see the link at the bottom of the screen. If it says Switch to new invoicing, then you’re on the classic invoicing screen. If it says Switch to classic invoicing, then you’re on the new invoicing screen.

When and How to Send an Invoice.

You have options when it comes to getting an invoice into your customer’s hands. One – Send a paper copy in the post. Two – Attach it to an email. Three – Use online invoicing.

* Post can still be best for customers that overlook emailed invoices, or don’t use email at all. But compared to other methods, post is slow, less secure, and harder to get right (addresses often change)

* Email addresses are easier to get right and the invoices arrive faster. Plus the invoice can’t really be lost. Just double-check you’re sending it to the right person or department.

* You can create an invoice online and send your customer a secure link to it. It’s nice and simple for them, and you can see when they’ve opened it. Better still, online invoices allow you to include a ‘pay now’ button. Customers just click through to pay immediately via credit card, debit card, or automated clearing houses (like PayPal) And yes, this way you will get paid quicker!

Accepting Payments

The easier you make it for your customers to pay you, the faster you will get paid. If you use Stripe or GoCardless, it is easy for your customers to pay immediately on any device. When they open the online invoice, they click on the ‘Pay now’ button. Online payment services cost nothing to set up, though there is a small fee for each transaction.

Better Online Protection

Xero online invoices and payments do provide better protection from fraudulent activity. Online payments are hard to tamper with, unlike PDF’s. Data in Xero is protected by multiple layers of security. Payment solutions that connect to Xero have robust security protections and have strong encryption.

Dealing with Overdue Payments

Sending automated and professional looking payment reminders, takes the stress and anxiety out of the whole process. Nobody likes chasing people for payments – it can make some people feel a bit awkward. Luckily, by using automation it avoids all of these feelings of apprehension and ensures speedy payment from your customer. It also protects that client/customer relationship because it doesn’t seem like it’s you personally doing the chasing.

Finally, the most important thing about invoicing is that you remember to do it! This may sound ludicrous, but people do forget.

Try to find a regular time that suits you to do your invoicing. That might be the end of the day or the end of the week. Put that time aside and just get on with it.

If it’s fast and simple to make an invoice, you won’t be so tempted to put it off. If it helps use a mobile app so you can invoice on the go from your phone.

Xero have produced a really helpful guide to invoicing. I’ve already signposted some clients to this. So have a look if you’ve not thus far, and it is of use.