Is Your Business Ready For Brexit?

7th December 2020Key businesses need to make sure they are ready for Brexit on January 1st . Changes are happening with regards to importing and exporting with potential disruptions to supply chains.

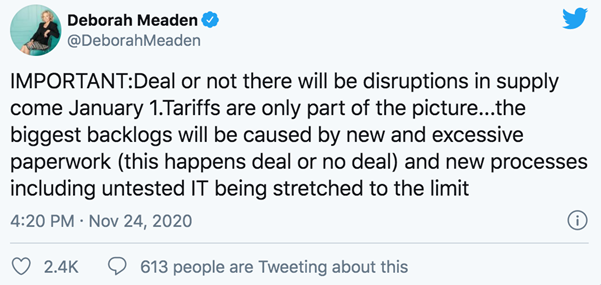

At times it looks like the chances of agreeing a deal with the EU is becoming ever less likely. TV’s Dragon Den ‘Deborah Meaden’ recently tweeted that there will be disruptions in supply whether we leave with a deal or not:

MICHAEL GOVE insisted businesses should have prepared for a change in the trading relationship with the European Union whether or not a Brexit deal will be in place.

Some have gone even further…

According to the boss of Europe’s largest haulage trade body, the UK is looking at a ‘nightmare scenario’ that will lead to ‘weeks, if not months’ of shortages.

So what can businesses do to prepare for these changes and potential issues?

Car makers are believed to be putting aside extra stock. Reason being in case the flow of goods to and from the European Union is disrupted at the end of the transition period.

However, there are many other practical things to do that apply to most businesses:

- Identify your staff who are non-UK EU citizens or who have close family members who are EU citizens. Retain your staff by helping them register under the EU Settlement Scheme

- Reassure your EU customers and suppliers that you will continue to deliver their expectations during and after the transition period. Check that your suppliers are also taking the necessary steps to ensure business continuity after the transition period ends.

- Make sure you have a UK EORI number. You’ll need a UK EORI (Economic Operator Registration and Identification) 12-digit number that starts with ‘GB’ to continue to move goods in or out of the UK. HMRC has already issued EORI numbers to VAT-registered businesses. If you are not VAT-registered, you will need to apply for an EORI number.

· Check the rate of tax and duty you’ll need to pay. Businesses holding inventory in the EU may become liable for EU VAT after the transition period. If so, seek professional advice on any tax liabilities and take action now to mitigate against increased business costs and risk.

- Understand the implications of changes at UK borders. Customs checks at border inspection posts will be needed after the transition period for certain goods including food and drink products, animals and animal products. Take account of the additional costs and delays this will entail.

- Carry out cash flow projections around broad anticipated cost increases. Speak to your bank in the first instance should you need flexibility for existing borrowing and any new borrowing requirements.

In the event that a UK/EU deal isn’t agreed by the end of the transition period, how would your business manage the resulting cost increases from new import and export tariffs?

- Identify any regulatory changes for your products or service. Create a key issues document, a timeline of actions and monitor this regularly.

- Familiarise yourself with the new UKCA (UK Conformity Assessed) marking, a new UK product quality assurance marking that must be used for goods being sold in Great Britain (England, Wales and Scotland) from 1 January 2021. It covers most goods which previously required the CE marking.

- Ensure that your employees can continue to travel between the UK and EU (plus Switzerland, Norway, Iceland or Liechtenstein). Check that you have at least 6 months left on your UK passport. Especially if you wish to travel to most countries in Europe (not including Ireland).

- Anyone taking their vehicle to the EU will be required to carry with them, a hard copy of their Green Card. This is an international certificate of motor insurance issued by UK insurance providers. This will ensure the motorist has the necessary third-party motor insurance for the countries in which they are driving.