Coronavirus Business Interruption Loan Scheme

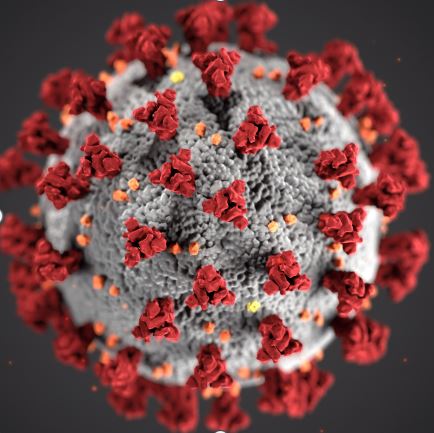

7th April 2020The Coronavirus Business Interruption Loan Scheme scheme helps small and medium-sized businesses affected by coronavirus (COVID-19) to access finance of up to £5 million.

The Coronavirus Business Interruption Loan Scheme (CBILS) supports small and medium-sized businesses, with an annual turnover of up to £45 million, to access loans, overdrafts, invoice finance and asset finance of up to £5 million for up to 6 years.

The government will also make a Business Interruption Payment to cover the first 12 months of interest payments and any lender-levied fees. This means smaller businesses will benefit from no upfront costs and lower initial repayments.

The government will also provide lenders with a guarantee of 80% on each loan (subject to pre-lender cap on claims) to give lenders further confidence in continuing to provide finance to small and medium-sized businesses.

The scheme is proided through commercial lenders, with the government backing from the government-owned British Business Bank.

There are 40 accredited lenders able to offer the scheme, including all the major banks.

Eligibility

You’re eligible if your business:

- is based in the UK

- has an annual turnover of up to £45 million

- has a borrowing proposal which the lender would consider viable, if not for the coronavirus pandemic

Businesses with a turnover over £45 million may be entitled to other government support.

Exceptions

The following businesses are not eligible to apply:

- banks, insurers and reinsurers (but not insurance brokers)

- public-sector bodies

- further-education establishments, if they receive grant-funding

- state-funded primary and secondary schools

How to apply

- Find a lender:

Eligible lenders can be found here.

- Approach a lender:

You should approach a lender yourself, ideally via the lender’s website.

Notes: There is high demand for CBILS facilities. Phone lines are likely to be busy and branches may not be able to handle enquiries in person.

Not every accredited lender can provide every type of finance available under CBILS, and the amount of finance offered varies between lenders.

Please see the lenders’ websites for more information on the amounts they are able to offer.

- The lender makes a decision:

The lender has the authority to decide whether to offer you finance.

Under the scheme, lenders will not take personal guarantees of any form for facilities below £250,000.

For facilities above £250,000, personal guarantees may still be required, at a lender’s discretion, but:

- they exclude the Principal Private Residence (PPR), and

- recoveries under these are to be subject to a cap of a maximum of 20% of the outstanding balance of the CBILS facility after the proceeds of business assets have been applied

- If the lender turns you down:

If one lender turns you down, you can still approach other lenders within the scheme.

Access to the scheme is now opento smaller businesses facing cashflow difficulties who previously would not have been eligible for CBILS because they met the requirements for a standard commercial facility.

You may therefore consider re-contacting your lender if you have previously been unsuccessful in securing funding.

One important aspect to bear in mind that the scheme is obviously in its infancy and the demand for finance is very high. A survey released on Wednesday by the British Chambers of Commerce showed that just 2% of respondents had successfully accessed the CBILS programme. So do not expect this to be a very quick process.

Caveats

The money provided under this scheme is a loan and not a grant. It will need paying back. It may be work considering other support mechanisms for your busienss at this time.

There are no stipulations on the interest rate on the loans. We understand that this is becoming a problem for some of these loans.

The banks are only agreeing to loans to commercially viable businesses, and initially were seeking personal guarantees and personal security on the loans. This mechanism is no longer an issue, due to the intervention by the Government for loans of less than £250,000, but the banks do appear to be dragging their feet over the provision of these loans.