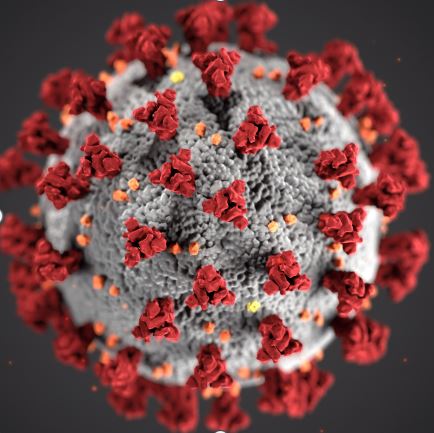

Coronavirus – What help is available to UK business?

19th March 2020of we Many UK businesses are currently very worried about the impact the Coronavirus (COVID-19) will have on the economy and their livelihoods.

On 17th March 2020 during the governments live broadcast, Chancellor Rishi Sunak announced a £350bn package of financial measures aimed at trying to alleviate the impact of the coronavirus on businesses. Mr Sunak told a press conference it was:

“An economic emergency. Never in peacetime have we faced an economic fight like this one.”

Cheap financing for businesses

A new Coronavirus Business Interruption Loan Scheme, delivered by the British Business Bank, will enable businesses to apply for a loan of up to £5 million. Businesses can access the first 6 months of that finance interest free, as government will cover the first 6 months of interest payments. However, the detail of how this will work in practice is not yet known. But we anticipate that loans will be available from next week (week commencing 23rd March 2020).

Simon Mason, Director at Simas Accounting & Tax, said that:

“This is a very good initiative, however, it runs the risk of just kicking the problem down the road. If you are considering this action as a business, ensure you have considered the repayment of the loan. This is a loan – not a grant or income – and will need to be repaid.

Ensure your cashflows and anticipated profits can absorb the future outlays before taking this on. And ensure your cashflows survive a stress-test. What happens if we are in lockdown for say 12 weeks (3 months) and then a further 2-3 months for the economy to start to move again? Would you be able to keep on top of the loan repayments? “

Repayment of Statutory Sick Pay during the Coronavirus Outbreak

For businesses with fewer than 250 employees, the cost of providing 14 days of Statutory Sick Pay per employee will be refunded by the government in full for vulnerable staff who self isolate and staff who catch the coronavirus. This will provide 2 million businesses with up to £2 billion to cover the costs of large-scale sick leave.

Simon Mason commented that:

“This change in the payroll system is has not been updated by the software houses as yet. The actual logistics of making the reclaim is not known yet. It may be that HM Revenue and Customs’ basic tools software. However, the speed of the repayment of this is not fully known, and is most likely to be a reduction in your PAYE payments, rather than cash coming in.”

Deferment of tax payments

A dedicated helpline has been set up to help businesses and self-employed individuals in financial distress. This includes outstanding tax liabilities. They will receive support with their tax affairs as a result of the coronavirus. Through this, businesses may be able to agree a bespoke Time to Pay arrangement. If you are concerned about being able to pay your tax due to COVID-19, call HMRC’s dedicated helpline on 0800 0159 559.

Simon Mason’s thoughts on this are:

“Again a great initiative to be offering. However, there could be potential hidden knock on effects from taking advantage of the Time to Pay.

We urge any businesses who work in the Construction Industry but have a gross payment status for CIS purposes to strongly reconsider from taking advantage of this. The Gross Status is avaailble to businesses with the caveat that the business is up to date with it’s taxes. By taking a Time to Pay arrangement, these businesses fail on that caveat, and fall into a 20% deduction rate. So by perhaps saving on your VAT or PAYE for 2 -3 months, you run the risk of reducing the cash receiveable from future sales. This could be by some 20% for up to 15 months.”

Cash grants

There will be a £10,000 cash grant to our smallest businesses, delivered by local authorities.

Small businesses that pay little or no business rates and are eligible for small business rate relief (SBBR) or rural rate relief will be contacted by their local authority – they do not need to apply.

The funding will be avaialble to local authorities in early April. Guidance for local authorities on the scheme will be provided shortly.

Simon Mason said on this:

“We will be following this closely for a lot of our clients. We will most probably be recommending for our clients to apply.”

Business Rates holiday

Finally, the government is introducing a business rates holiday for retail, hospitality and leisure businesses in England for the 2020 to 2021 tax year.

A £25,000 grant will also be available to retail, hospitality and leisure businesses operating from “smaller premises”. “Smaller premises” are those with a rateable value between £15,000 and £51,000.

Simon’s thoughts on this were:

“Again a very strong initiative and very much welcomed. However, the detail on this suggests that the local authorities will contact the businesses concerning this. With the widespread contagious nature of the virus, and the sheer workload in relation to this, it may mean that this money is not available immediately.”

Enquiries on the eligibility for, or provision of, the reliefs should bemade from the relevant local authority.

In addition, the decisions announced by the Bank of England on 11 March 2020 mean that banks are in a better position to provide additional credit to smaller businesses.

Summary

Mr Sunak said:

“This is not a time for ideology and orthodoxy, this is a time to be bold, a time for courage. I want to reassure every British citizen this government will give you all the tools you need to get through this.”

At Simas Accounting & Tax, we wish evey business well in the forthcoming difficult weeks and months following this coronavirus outbreak. It will be a difficult time, and “cash will be king”. We recommend getting a hold of your finances and know the worst possible case position. Use the goodwill you have built with your customers and suppliers and most importantly talk to them. They will be in the same position as you but hopefully we can work through this together. There is a lot of goodwill out there – and now is the time to use it.

Please do contact us if you would like to discuss your own financial position with us.