Can Tax Be Taxing?

17th January 2022How Income Tax and Personal Allowance works

Income Tax

Income tax is the tax charged on most types of income; the most common type being wages and salaries but can also include any profits from a businesses owned, dividends from investments, rent, and more. There are however exceptions that are tax free, for example:

- The first £1,000 of income from self-employment – called your ‘trading allowance’

- Income from tax exempt accounts (like ISAs and National Savings Certificates)

- £2,000 on dividends as a ‘dividends allowance’

- Premium bonds or National Lottery wins

Income Tax Relief

‘Tax relief’ means that you either:

- pay less tax to take account of money you’ve spent on specific things, like business expenses if you’re self-employed

- get tax back or get it repaid in another way, like into a personal pension

You get some types of tax relief automatically – but some you must apply for.

When You Can Get Tax Relief

Tax relief applies to pension contributions, charity donations, maintenance payments and time spent working on a ship outside the UK.

It also applies to work or business expenses – you may be able to:

- get tax relief on what you spend running your business if you’re self-employed (a sole trader or partner in a partnership)

- claim tax relief if you’re employed and you use your own money for travel and things that you must buy for your job

Personal Allowance

The standard personal allowance is £12,570, which is the amount of income you do not have to tax on. This allowance will vary if you claim Marriage Allowance, Blind Person’s Allowance or your income is over £100,000.

- Marriage Allowance allows you to transfer £1,260 of your personal allowance to your civil partner, increasing their personal allowance by that amount.

- Blind Person’s Allowance is a simply an increase to your tax-free allowance.

- However, if you are earning over £100,000, your personal allowance goes down by £1 for every £2 you earn, so if you earn £125,140 your personal allowance will decrease to zero.

There is more information on tax-free income and personal allowance at https://www.gov.uk/income-tax-rates.

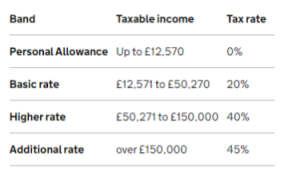

Income Tax Rates and Bands

The table below shows the tax rates you pay in each band if you have a standard personal allowance of £12,570. Please note that income tax bands are different if you live in Scotland. This information can be found at https://www.gov.uk/scottish-income-tax.

According to this table, if your total taxable income was £90,000. The first £12,570 you earned would be tax free, the next £37,700 would be taxed at a rate of 20%, and the remaining £39,730 taxed at 40%.

This amount would differ if you do not have the standard personal allowance. There is a similar table with this additional information on at https://www.gov.uk/government/publications/rates-and-allowances-income-tax/income-tax-rates-and-allowances-current-and-past#tax-rates-and-bands or similarly, a calculator to help you estimate your income tax for the year at https://www.gov.uk/estimate-income-tax.

Self-Assessment

Self-assessment is the system HMRC uses to collect income tax. Tax is usually deducted automatically from wages, pensions and savings but you must send a tax return if you are self-employed as a ‘sole-trader’ and earned more than £1,000 (before any tax-reliefs) or a partner in a business partnership or if you have any untaxed income, such as:

- Money from renting out a property

- Tips and commissions

- Income from savings, investments and dividends

- Foreign income

To discuss whether or not you may need to send a tax return or to get more information specific to you, please feel free to call or email us at Simas Accounting & Tax.